Scientific Portfolio Technology

for Equity Investors

We provide investors with the technology to independently analyze and construct equity portfolios

Use Cases

Leverage Scientific Portfolio’s capabilities and follow along with a practical use case that is designed to extract meaningful insights for a specific investment objective.

This documentation is exclusively available to platform users. Request access to the Scientific Portfolio platform now to get started.

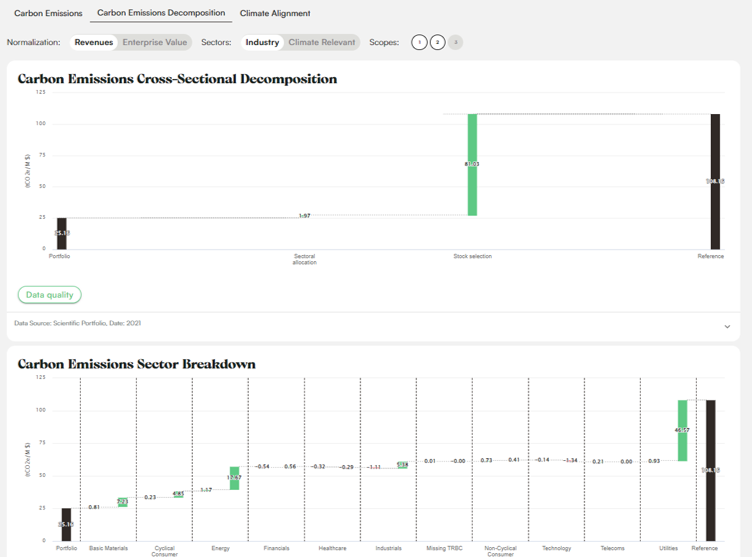

Manage the tradeoff between climate impact and financial objectives

Pursue a climate impact objective by first conducting an independent review of existing low carbon strategies and then showing how analytics can help infer insights by testing a customized low carbon portfolio that balances out extra-financial and financial considerations.

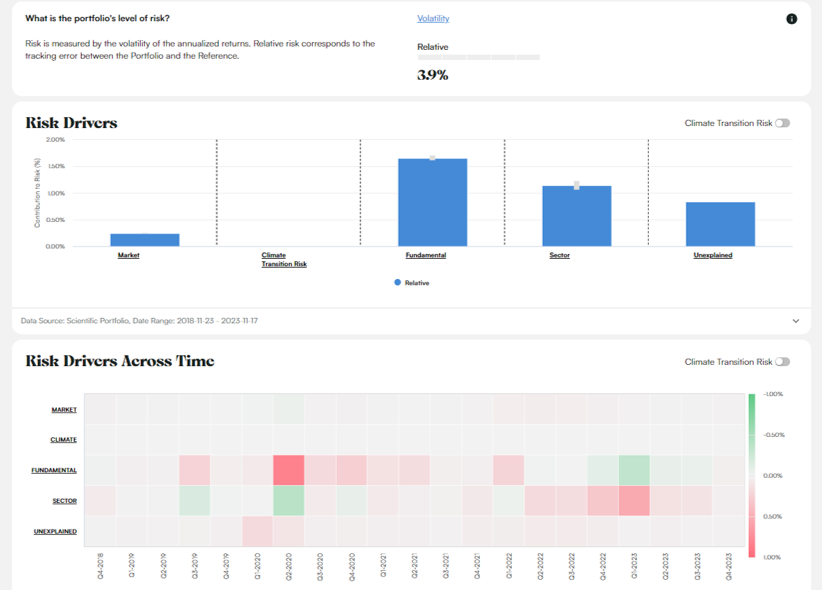

Detect and quantify transition risk in any investment strategy

Independently analyze the risks underpinning a traditional investment strategy such as a defensive mix of low volatility and high dividend. Identify an outsized exposure to climate transition risk and use our interactive analytics to identify insights on how to reduce the transition risk exposure.

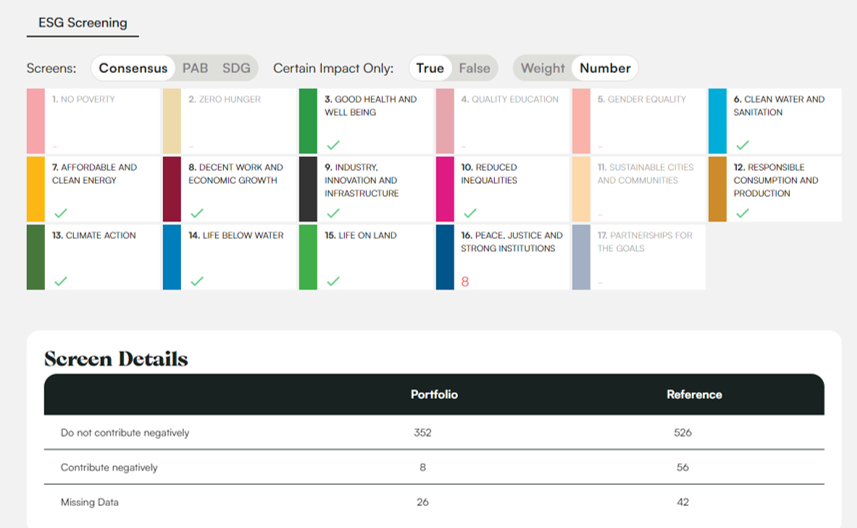

Evaluate adherence to stated ESG objectives while uncovering unintended financial consequences

Review the stated objectives of an ESG index and use the Scientific Portfolio platform to independently assess whether the index fulfills its objectives. Uncover any unintended financial consequences resulting from the pursuit of extra-financial ESG objectives.

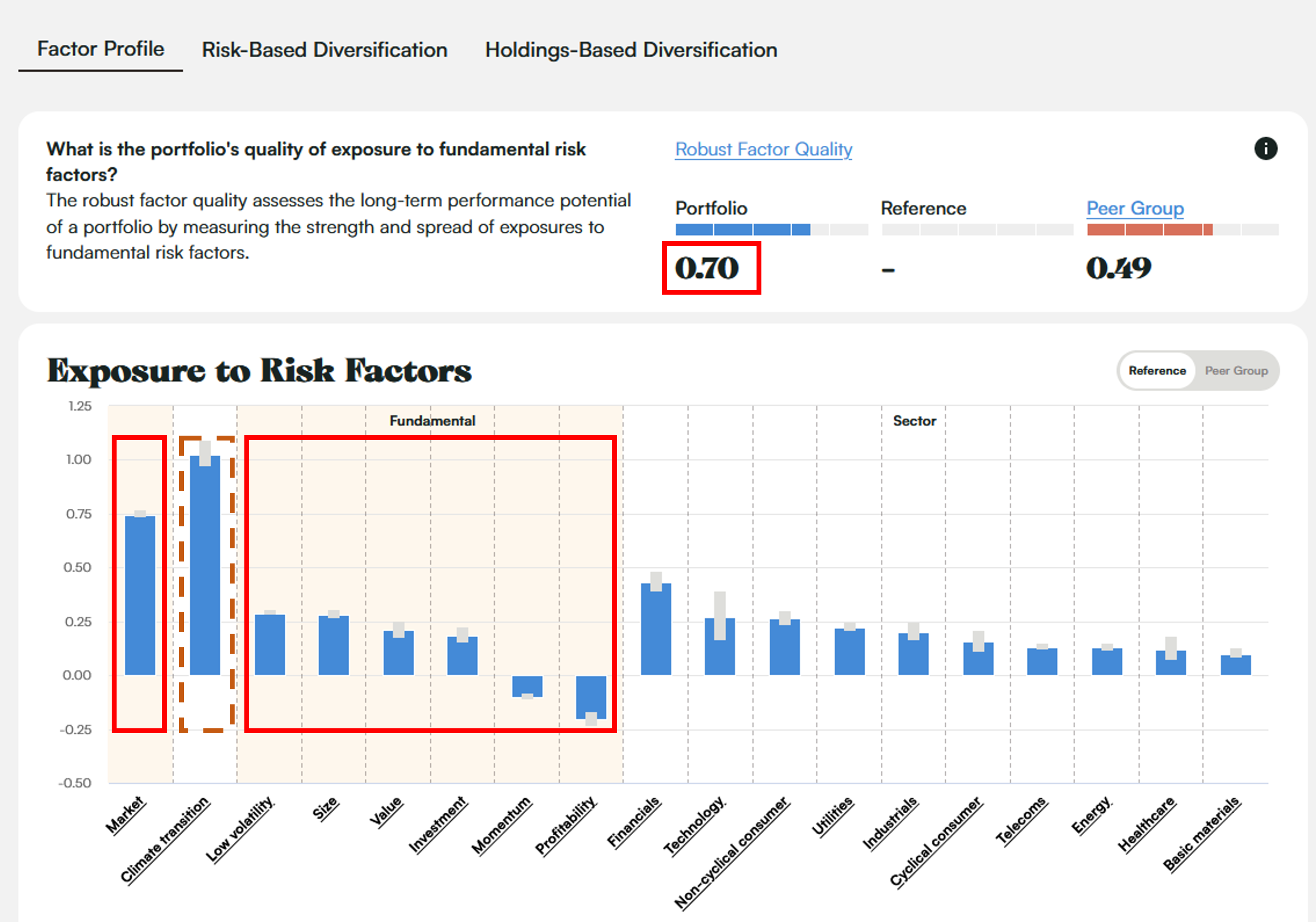

Go beyond backtested performance to analyze a factor-based strategy

Explain the ex-post performance and risk of smart beta investment strategies (both from an absolute perspective and relative to a cap-weighted benchmark) and independently assess their ex-ante risk-adjusted return potential.

Latest Publications

This paper evaluates and decomposes the financial and extra-financial impacts of ESG “do no harm” exclusions on equity portfolios.

Macroeconomic Regimes for Conditional Simulations of Equity Portfolios

Changing macroeconomic conditions have the potential to strongly influence equity portfolio returns. This paper examines how key macroeconomic regimes affect the statistical characteristics of equity returns.

This paper addresses climate transition risks in portfolio management by introducing a model that integrates firm-specific ‘green’ revenues, aligned with the European taxonomy, with economic and energy variables from adverse transition scenarios.

Key Functionalities

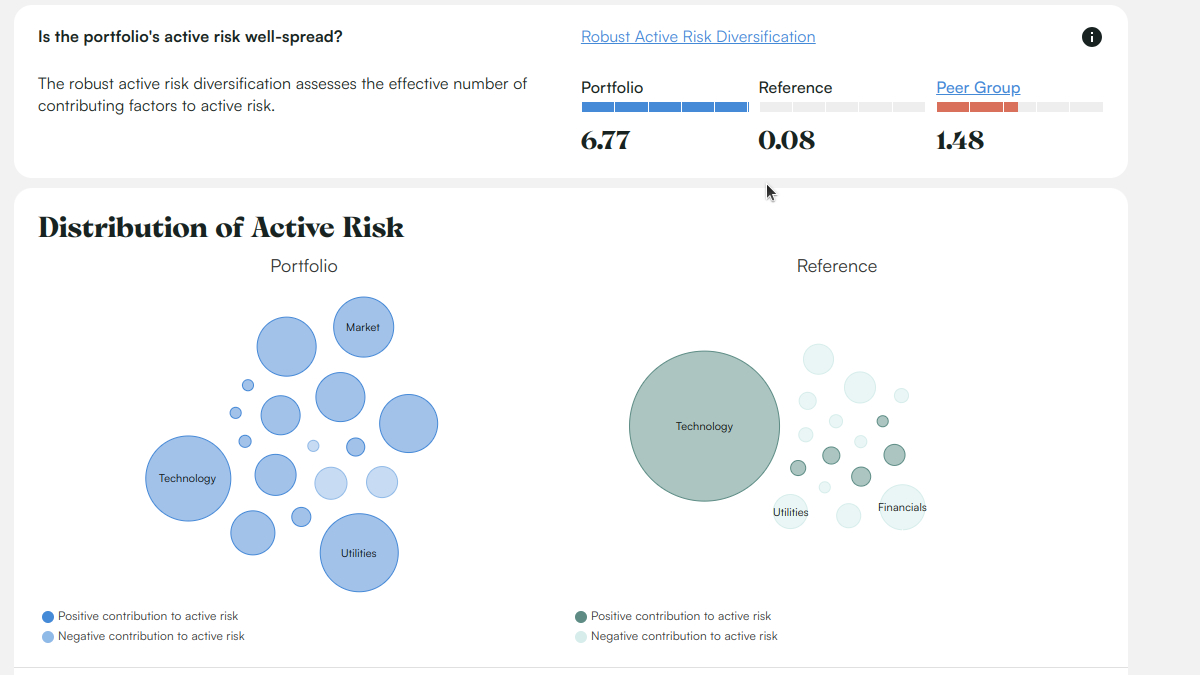

- Diversification

- Climate Transition risk

- Risk budgeting

- Macro regime sensitivity

- Factor Analysis

- ESG Impact

- Climate Impact

- Knowledge Center

Gauge the balance across long-term fundamental, rewarded risks while checking for short-term risk concentrations and idiosyncrasies.

Frequently Asked Questions

What is Scientific Portfolio?

Scientific Portfolio is the latest commercial venture incubated within the research ecosystem of EDHEC Business School (EDHEC), one of Europe’s top business schools.

We have assembled a team with a broad range of expertise and backgrounds, including financial engineering, computer science, sustainable and climate finance, and institutional portfolio and risk management.

We proudly carry EDHEC’s impactful academic heritage and aspire to provide investors with the technology they need to independently analyze and construct equity portfolios from both a financial and extra-financial perspective.

What makes Scientific Portfolio unique?

We provide access to a neutral, comprehensive, and independent technology platform for investors to assume full control of their equity portfolio analysis and construction processes.

Additionally, our conceptual, research-driven framework integrates sustainability and climate alignment objectives into financial decisions. Our users may therefore choose to assess risk and performance out of sample, evaluate the impact of a sustainable policy on financial risks, assess the consistency of a climate impact strategy, get a feel for the tradeoff between carbon intensity and tracking error, or simply review their factor exposures and detect risk concentrations in their portfolio. All independently.

Finally, we stay true to our EDHEC heritage by delivering an academically-minded Knowledge Center that both assists and empowers investors on their learning journey.

What are the benefits of Scientific Portfolio for Institutional Asset Owners?

Scientific Portfolio endeavors to adopt a neutral point of view based on academic consensus and empower Institutional Asset Owners so they can analyze an investment strategy and infer actionable insights without depending on the commercial provider of the strategy.

More specifically, we help investors verify the sustainability of an investment solution that is offered to them and detect and evaluate the unintended financial risks caused by a sustainable investment policy.

For example, Institutional Asset Owners can use the platform to assess the consistency of a climate impact strategy or get a feel for the tradeoff between carbon intensity and tracking error, while reviewing their factor exposures and detecting risk concentrations in their portfolio. All independently.

What are the benefits of Scientific Portfolio for Asset Managers?

Scientific Portfolio endeavors to equip Asset Managers with the technology to enhance and elevate their dialogue with end investors that wish to analyze an investment strategy without fully depending on the commercial provider of the strategy.

More specifically, our neutral point of view based on academic consensus helps managers demonstrate they have pursued the investment objectives set by a client, as well as highlight unintended consequences (whether financial or extra-financial) of customizations requested by the client.

For example, Asset Managers can use the platform to demonstrate the consistency of a climate impact strategy or the risk efficiency of a carbon intensity reduction or provide evidence of their sound management of risk exposures and factor concentrations. All independently.

What are the benefits of Scientific Portfolio for Wealth Managers?

Scientific Portfolio endeavors to adopt a neutral point of view based on academic consensus and assist Wealth Managers so they can analyze and select an investment product without depending on its commercial provider.

More specifically, we help advisors verify whether a given fund’s strategy is aligned with their end clients’ investment objectives and whether it may additionally be a good fit for their overall portfolio.

For example, Wealth Managers can use the platform to assess the out-of-sample performance and risk behavior of a given instrument, or to benchmark and rank its sustainability against a broader universe of instruments, or to find a suitable replacement fund while accounting for the risk exposures of the rest of the overall portfolio. All independently.