Why Scientific Portfolio?

We provide investors with the technology they need to independently analyze and construct equity portfolios, from both a financial and extra-financial perspective.

Finally, all of equity portfolio science delivered into one single platform.

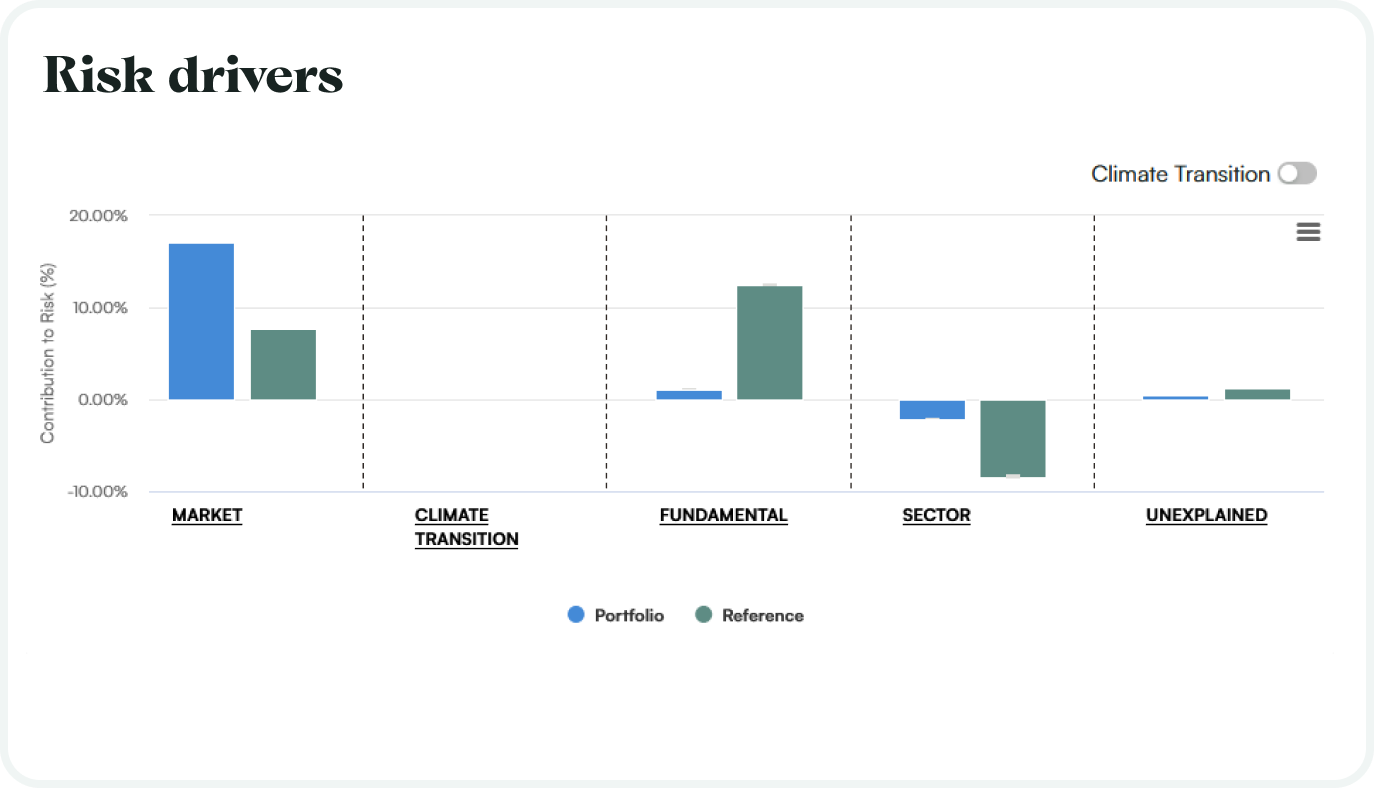

Stop focusing on past performance.

Start investing based on risk.

Choices based on past performance are no better than a coin flip. Predictions based on risk are accurate almost nine times of out ten*. Why not use forward-looking risk insights to make smarter investment decisions?

*Empirical data available upon request.

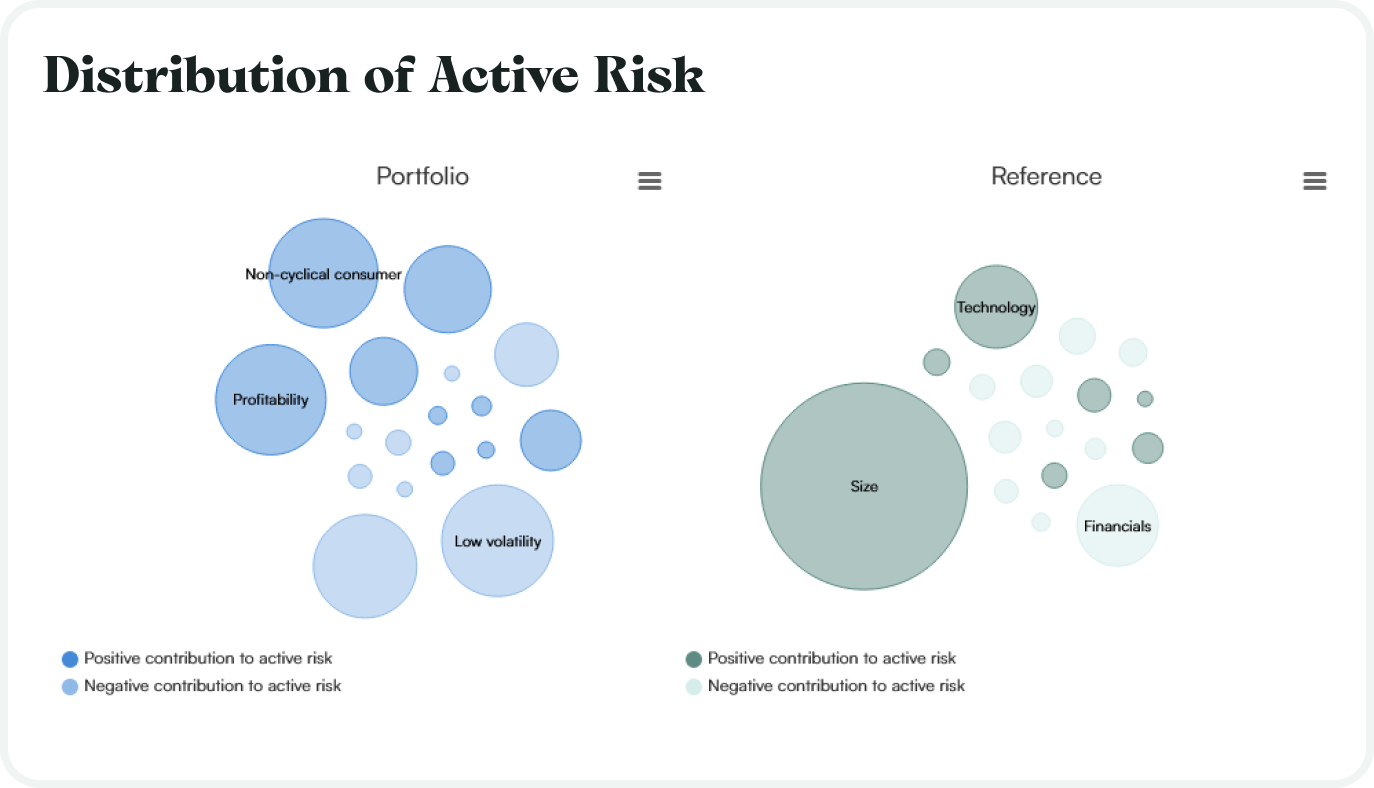

Stop looking for the best strategy on a standalone basis.

Start seeking strategies that diversify your overall portfolio.

An investment strategy selected on a standalone basis may not fit your broader portfolio. It could lead you to double up on existing exposures and expose you to concentration risk. Why miss out on the benefits of an overall diversified portfolio?

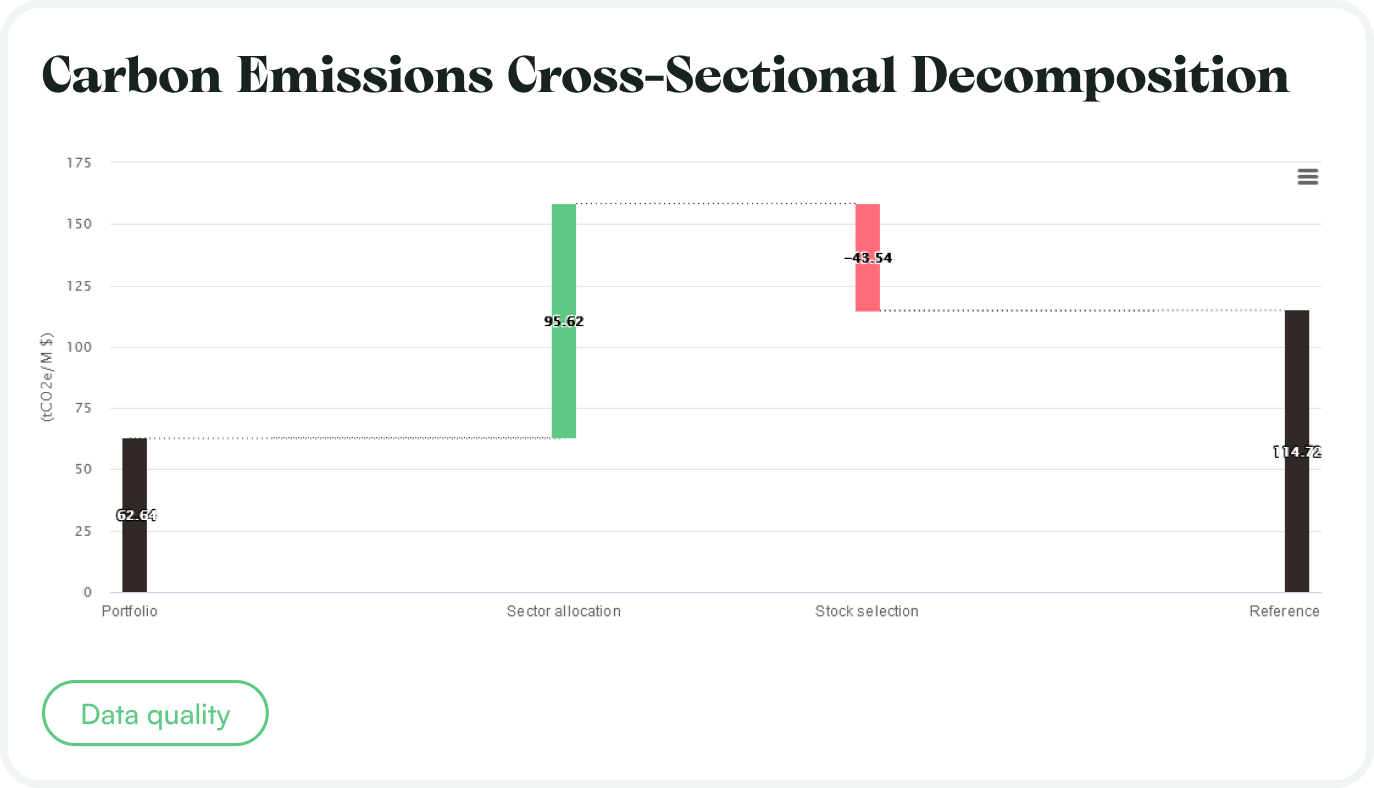

Stop investing in low carbon funds at odds with your alignment policy.

Start evaluating a climate strategy based on its decarbonization drivers.

Reducing a portfolio's carbon footprint by excluding high-emitting sectors entirely or by selecting best-in-class companies in each sector are two fundamentally different climate alignment philosophies. Why not judge your low carbon portfolios based on how they have decarbonized?

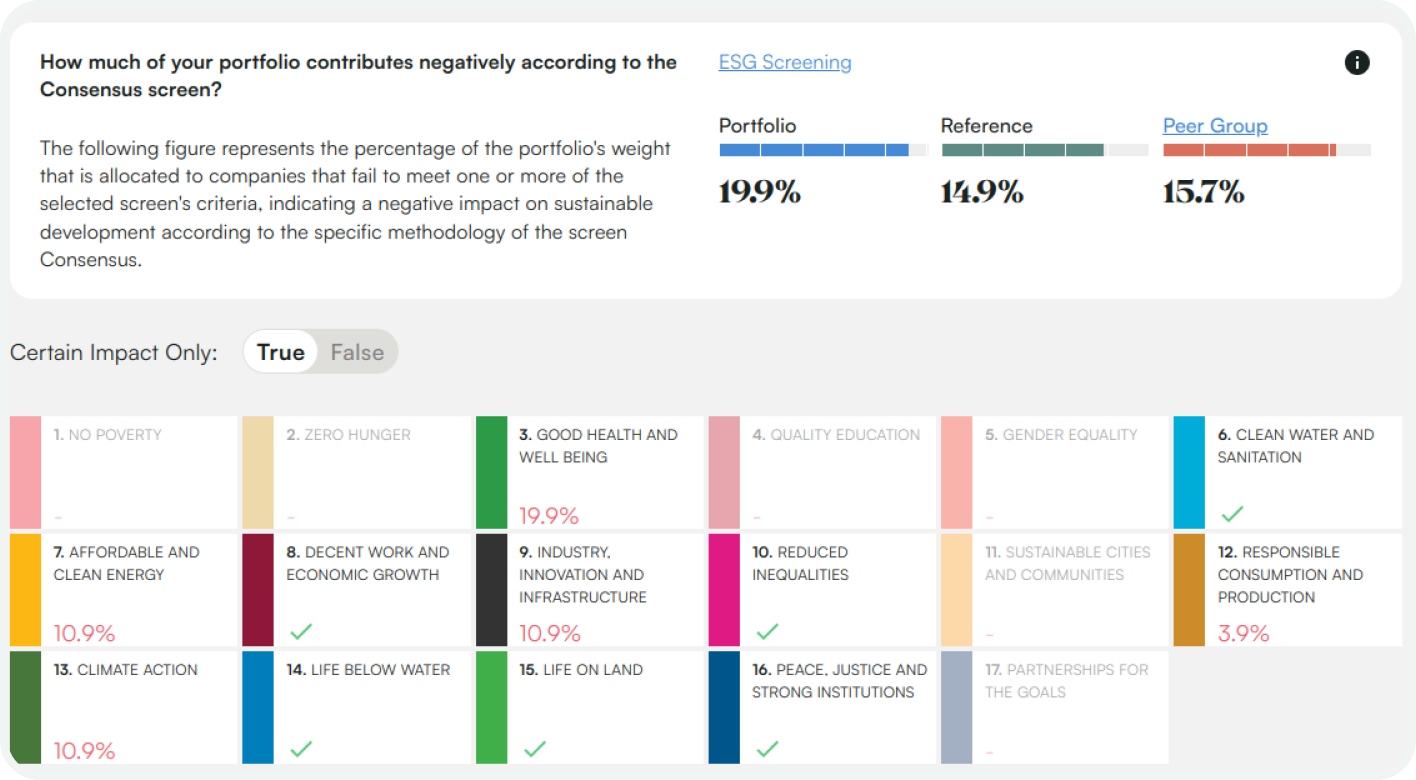

Stop relying on generic ESG labels that lack transparency.

Start assessing a portfolio's sustainability based on its holdings.

Sustainability is historically and fundamentally a "Do No Harm" injunction, so sustainable investing starts with knowing exactly what portion of the portfolio is currently unsustainable. Why not screen your portfolio so you can decide which harmful companies you wish to exclude, underweight or engage with?

Scientific Portfolio Technology for Equity Investors

We provide investors with the technology to independently analyze

and construct equity portfolios